1. Endorsement of Task Force on Climate-related Financial Disclosures (TCFD) Recommendations

In July 2021, the Group formulated our ESG Management Declaration, and we are promoting management aimed at balancing the realization of a sustainable society with the enhancement of our corporate value.

Now, the Group has expressed its endorsement of the TCFD Recommendations, which were announced in 2017 and revised in October 2021 by TCFD. We have also assessed the risks and opportunities that climate change poses to society and companies in line with the Recommendations and evaluated the status of the Group’s resilience.

Currently, we are mainly analyzing how to control the impact on business resulting from our response to the risks posed by climate change. In the future, we also plan to analyze and disclose business growth opportunities.

* TCFD (Task Force on Climate-related Financial Disclosures)

Established in 2015 by the Financial Stability Board (FSB) at the request of the G20

2. Details of Efforts to Address Climate Change Based on TCFD Recommendations

Governance

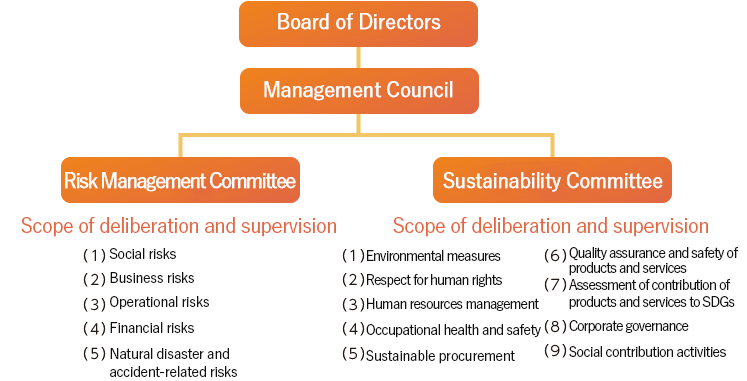

The Group recognizes climate change as a key issue in ESG management. The Sustainability Committee, chaired by the President & CEO, discusses and supervises basic policies related to sustainability, as well as strategies and tactics in business activities and corporate operations, and regularly reports these matters to the Board of Directors. The matters discussed by the Sustainability Committee are incorporated into management strategies, risk management, business budgets, and capital investment decision-making processes.

System for promoting sustainability

The Group’s Sustainability Committee is composed of all officers, excluding Outside Directors, and participates in all aspects of assessing and managing climate-related risks and opportunities.

Composition of the Sustainability Committee

| (1) Chairman | President & CEO |

|---|---|

| (2) Vice-chairman | Vice President & Executive Officer |

| (3) Committee members | Executive Officers other than (1) and (2) Observer: Full-time Audit and Supervisory Committee Member |

| (4) Secretariat | ESG Promotion Department |

Strategy

1. Overview of scenario analysis

In order to identify the risks and opportunities related to climate change that could affect the Group’s business, we have conducted a scenario analysis for the Fish-Paste Products and Prepared Foods Business and the Mushroom Business, which are our main businesses. The scenario analysis is based on model scenarios published by international organizations and others, and creates two scenarios: a 4°C scenario and a 2°C scenario, for analysis and assessment.

<Reference scenario> Intergovernmental Panel on Climate Change (IPCC)

・SSP Scenario, SSP 3-7.0 and SSP 1-2.6

・RCP Scenario, RCP 6.0 and 2.6

(1) Changes in the environment and impact on the Company’s business based on assumed scenarios

This table can be scrolled

| 4°C scenario SSP 3-7.0 RCP 6.0 |

2°C scenario SSP 1-2.6 RCP 2.6 |

||

|---|---|---|---|

| Overall | Although efforts to combat climate change have begun in developed countries, developing countries continue to face technological and financial difficulties, and reductions in global GHG emissions have not been sufficient. As a result, natural disasters caused by abnormal weather such as typhoons and torrential rains are occurring more frequently in wider geographical areas than at present. The risks of asset loss and stagnant distribution networks due to floods are increasing. Japan has not experienced progress with the introduction of carbon pricing, and fossil fuel-based energy continues to account for a large proportion of energy composition. In terms of energy technology, new technological developments to solve Scope 1 (in-house combustion ) have not been achieved. For companies, the transition to renewable energy in association with cost increases is gradual, and the financial impact in this regard remains low. |

International frameworks, laws and regulations for addressing climate change are being enforced, with carbon pricing and the carbon border adjustment mechanisms introduced, among others. Although the temperature rise is being kept to within 2°C as a result of international collaborative efforts, temperatures will increase by around 1°C from the current level. The frequency of natural disasters will also remain at around the same level as present. The government’s proactive investment in climate change issues has accelerated the development of energy-related technologies, enabling companies to select specific measures to reduce GHG emissions. Nonetheless, the introduction of carbon pricing not only increases a company’s energy costs (including taxes), but also affects the cost of raw materials purchased. |

|

| Fish-Paste Products and Prepared Foods Business | In the seawaters around North America, the Arctic, and Southeast Asia, changes to the ecosystem structure of marine organisms (fish), habitat (fishing grounds) and growing season (fishing season) are starting to become more apparent, and the securing of raw materials (surimi) has become unstable. However, the volume of catches in the waters off Japan is increasing, despite changes in the content. The global water shortage is affecting food production, supply, and demand, resulting in rising prices of materials such as soybeans and wheat. Such depletion and destabilization of conventional raw materials have accelerated the development and practical application of alternative raw materials and farmed raw materials, etc., and opportunities for their utilization are expanding. In Japan, prolonged high summer temperatures have become normal. When it comes to food, the purchasing period for spring and summer products has become extended, while demand for autumn and winter products is on the decline. |

The production volume of raw material (surimi) has not changed much from the current situation, but as efforts to reduce GHG emissions progress, there is a shift from eating meat to eating fish, and prices continue to remain at a high level due to changes in the balance of supply and demand. Although there has been no major change in the impact on global food production, the demand for food is increasing as the population increases in developing countries, and the balance of supply and demand, especially for major grains, is fraught with risk. Raw material prices for fish-paste products and prepared foods are on an upward trend. Since the frequency of days temperature of 30°C or higher has not changed significantly, the sales period for spring and summer products tends to be longer while the sales period for autumn and winter products tends to be shorter. |

|

| Mushroom Business | As temperatures rise, the energy cost of cultivation, particularly the cost of air conditioning for cultivation, is increasing. In addition, capital investment or new contracts for new energy supply sources are needed in order to secure required volumes. Abnormal weather (temperatures, rainfall) is affecting forests, and the supply risk of sawdust, which is used for fungal beds, is beginning to rise. In addition, global water shortages are affecting raw materials for fungal bed nutrients, leading to cost increases. |

As the average temperature rises by 1°C from the current level, the cost of air conditioning for cultivation is increasing. | |

(2) Results of scenario analysis

- (i) We recognized that the impact on marine resources, which are important raw materials for our Fish-Paste Products and Prepared Foods Business, is significant, and that there are changes in current fish species, fishing grounds, and fishing seasons. Although the Company does not directly catch fish, we need to deal with the impact on raw material purchasing costs and on changes to fish species.

- (ii) With regard to the impact on energy, which has a major impact on the Group’s business, as a response to the reduction of CO₂ emissions in line with the government’s decarbonization policy, we confirmed that until such time that we achieve green energy generation for Scope 2 and the development of corresponding technology for Scope 1, there will be a financial impact based on the premise of carbon tax payments.

- (iii) With regard to the financial impact of climate change, we are at the stage of having started simulations of the impact on energy costs and the timing of the introduction of carbon pricing, and we will proceed with calculations, including the scope of the environmental costs.

2. Identification of risks and opportunities

This table can be scrolled

| Risks and opportunities | Impact on business | Impact | |||

|---|---|---|---|---|---|

| 4℃ | 1.5-2.0℃ | ||||

| Transition risks | Market | Carbon pricing | Higher energy conversion costs or higher taxes | Small | Large |

| Electricity price | Increased costs due to soaring electricity price | Small | Large | ||

| Crude oil price | Increased costs due to soaring crude oil price | Small | Large | ||

| Changes in consumer tastes | Decrease in market share due to inability to respond to changes in consumer needs (Non-buying of environmentally hazardous products, reduced sales of autumn and winter products, etc.) |

Large | Small | ||

| Policies & legal regulations |

Plastic regulations | Soaring raw material prices in line with the shift to eco-friendly materials | Small | Large | |

| Strengthened policies to reduce CO₂ emissions overseas | Decrease in sales due to stricter import/export regulations | Small | Large | ||

| Reputation | Changes in investor assessment | Assessment downgraded due to inability to meet the demands (environmental load measures) of investors (individuals/institutions) | Medium | Medium | |

| Physical risks | Acute | Increase in heavy rain disasters | Damage caused by flooding or submergence at factories and centers | Medium | Small |

| Release of underground harmful bacteria | Suspension of business activities due to the outbreak of a pandemic | Medium | Small | ||

| Chronic | Changes in labor laws | Increased costs due to restrictions on work in high-heat areas and outdoors due to rising temperatures | Large | Small | |

| Rise in sea levels | Flood risk in Niigata Prefecture: suspension of operations at factories and warehouses | Medium | Small | ||

| Changes in vegetation | Difficulties in procuring sawdust | Medium | Small | ||

| Oxidation of the ocean and increase in ocean temperature | Soaring raw material prices due to a decrease in fish and shellfish and changes in fishing grounds | Large | Medium | ||

| Longer construction periods | Increases in time and costs resulting from shorter working hours due to extreme heat | Medium | Small | ||

| Opportunities | Reputation | Use of renewable energy | Differentiation from competitors through energy switching | ||

| Market | Development and dissemination of new technology | Utilization of CO₂ emitted by mushrooms | |||

| Rise in ocean temperature | Expansion of fishing grounds due to a reduction in Arctic waters | ||||

Risk management

Risk management related to climate change is incorporated into the company-wide risk management system through cooperation between the Sustainability Committee and the Risk Management Committee. Climate change risk management is based on ISO 14001.

|

|

|

Metrics and targets

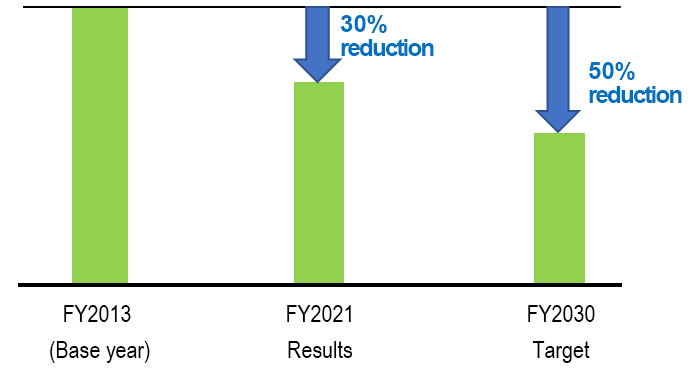

In order to reduce the impact of climate change issues on management and business, and to assess and manage initiatives, the Group has established CO₂ emissions as a metric and set a target of reducing CO₂ emissions by 50% by FY2030 (compared to FY2013). The “medium- to long-term CO₂ emissions reduction targets” were set following deliberations by the Sustainability Committee in August 2022, and adopted by the resolution of the meeting of the Board of Directors held in the same month.

[CO₂ emissions reduction target] (Total emissions in Scope 1 and Scope 2)

Efforts to date have been progressing smoothly, and we achieved a reduction of around 30% in FY2021 compared to the base year.

Looking ahead to FY2030, in addition to promoting energy savings, we will promote the installation of solar power generation equipment, switch to the use of renewable energy power, and switch to low GWP of fluorocarbon equipment, aiming for a 50% reduction compared with the base year.

On the other hand, the calculations for Scope 3, which also form the basis for cooperation with the supply chain, are at the stage of being completed with regard to purchased raw materials, and we are currently proceeding with calculations in other areas. We are conducting environmental study sessions with everyone in the supply chain, albeit at a partial level, and have started sharing information on the current situation and future initiatives.